The IBM Q2 2024 earnings call reported strong financial results, demonstrating solid revenue growth, increased profitability, and significant cash-flow generation. Below are the key highlights from the earnings call:

Financial Highlights:

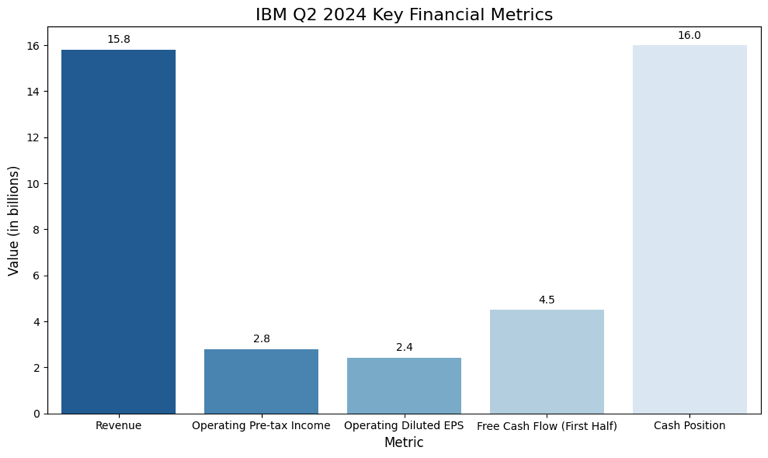

- Revenue: $15.8 billion, a 4% increase at constant currency.

- Operating Pre-tax Income: $2.8 billion, a 17% increase year-over-year.

- Operating Diluted EPS: $2.43, an 11% increase year-over-year.

- Free Cash Flow: $4.5 billion in the first half of 2024, the strongest in many years.

- Cash Position: $16 billion, up $2.5 billion since year-end 2023.

IBM Q2 2024 Key Financial Metrics

| Metric | Q2 2024 | Year-over-Year Growth |

|---|---|---|

| Revenue | $15.8 billion | +4% |

| Operating Pre-tax Income | $2.8 billion | +17% |

| Operating Diluted EPS | $2.43 | +11% |

| Free Cash Flow (First Half) | $4.5 billion | +$1.1 billion |

| Cash Position | $16 billion | +$2.5 billion |

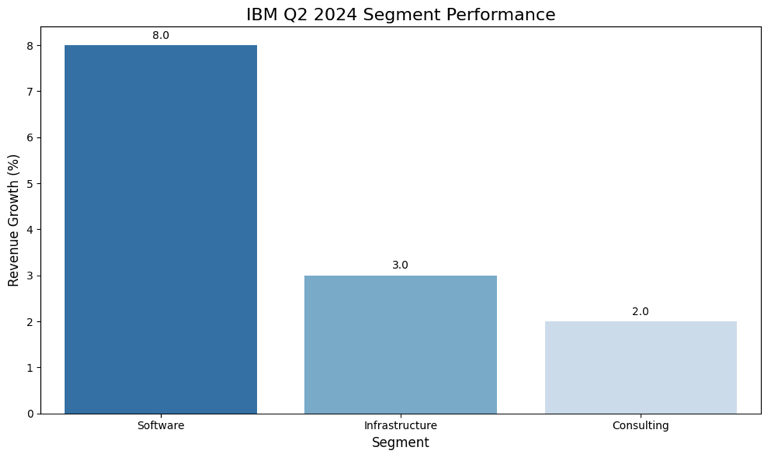

Business Segment Performance

- Software: 8% revenue growth, driven by strong performance in hybrid platforms and solutions, and transaction processing.

- Infrastructure: 3% revenue growth, with IBM Z revenue up 8% and strong performance in distributed infrastructure.

- Consulting: 2% revenue growth, impacted by discretionary spending constraints but offset by strong demand for large engagements in AI and analytics.

IBM Q2 2024: Segment Performance

| Segment | Revenue Growth | Notable Highlights |

|---|---|---|

| Software | +8% | Driven by hybrid platforms and solutions |

| Infrastructure | +3% | Strong performance in IBM Z and distributed systems |

| Consulting | +2% | Impacted by discretionary spending constraints |

Strategic Initiatives and Innovations:

- AI and Hybrid Cloud: IBM’s AI strategy, including the introduction of watsonx and the generative AI platform, continues to show strong momentum. The AI book of business exceeds $2 billion, with a significant portion in consulting signings.

- Open Source AI Models: IBM open-sourced its Granite AI models under the Apache 2.0 license, fostering innovation and developer engagement. These models offer significant cost savings and customization potential compared to larger models.

- Partnerships: New AI partnerships with industry leaders like Adobe, AWS, Microsoft, and others were announced, enhancing IBM’s ecosystem and market reach.

Key Takeaways from the Q&A Session:

- Transaction Processing: IBM’s transaction processing performance was notably strong, with 13% growth attributed to solid client renewals and large deal performance.

- Consulting Dynamics: The consulting segment is experiencing a shift in client spending towards AI-related projects, reflecting broader market trends and the early stages of AI adoption.

- M&A Strategy: IBM remains focused on strategic acquisitions in hybrid cloud and AI, maintaining discipline in valuation and synergy realization. The pending HashiCorp acquisition is expected to enhance IBM’s hybrid cloud capabilities.

Future Outlook:

- Revenue Growth: IBM expects full-year constant-currency revenue growth in the mid-single-digit range.

- Free Cash Flow: Revised upward to greater than $12 billion for the year.

- Segment Growth:

- Software: High single-digit growth expected.

- Consulting: Low single-digit growth anticipated, with improvements in profit margins.

- Infrastructure: Expected to remain neutral for the year.

IBM Q2 2024 In Pills:

IBM’s strong performance in Q2 2024 reflects the company’s successful execution of its AI and hybrid cloud strategy. The continued investment in innovation, strategic acquisitions, and robust financial management position IBM well for sustained growth and leadership in the technology sector.

Main